Why GRIDS

Nowadays fewer than 3% of European consumers purchase banking products such as credit cards, current accounts and mortgages from another Member State, and when it comes to consumer credit, Europeans buy only 5% of their loans from abroad.

Additionally, there is still limited support to attributes for Legal Persons by the eIDAS nodes in operation and unclear or not yet mature legal support at the national level to facilitate the integration with eIDAS infrastructure of private sector service providers.

In this context, GRIDS raises to facilitate the cross-border acceptance of e-identification and remote know-your-customer (KYC) processes where the aim is to enable banks to identify consumers digitally in compliance with anti-money laundering and data protection requirements, making full use of the electronic identification and authentication tools provided under eIDAS.

What GRIDS offers

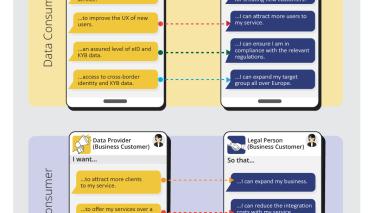

GRIDS will simplify the online remote onboarding of individual and business customers, mostly SMEs meanwhile it will specifically allow business platforms to enlarge their customer base across borders providing access to a secure digital environment where transaction participants are reliably identified and authenticated and where personal data protection principles are enforced and embedded in the interoperability frameworks.

Technical solution

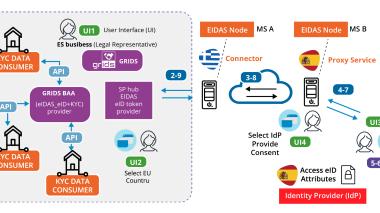

GRIDS will provide electronic one-stop-shop solutions for a complete and accurate KYC screening -including not only company information and documents (name, register number, country/jurisdiction, court or legal form) but also the identification of legal and natural persons through effective access to the cross-border functionalities of a well-established eID DSI and eIDAS core service platform.

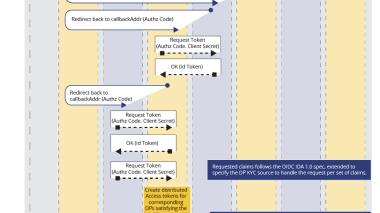

To do so, GRIDS will operate a business infrastructure that facilitates and reduces the cost of KYC operations by establishing a business network, in the form of a Single-Sign-On (SSO) federation, between KYC providers (Data Providers), their customers from the financial, telecom and e-commerce sectors (Data Consumers) and the clients of these industries (Data Subjects). This network will propagate the identity information and the eIDAS authentication token obtained at one node of the network and bundle KYC data with the identity data of Data Subjects.

Infrastructure and service flow diagrams

More detailed information is available here

More detailed information is available here